Most of our market updates have a fair bit of reflection from the previous months, followed by a bit of speculation. However, the beginning of a new year generally brings with it a shift in the market and so our January edition always forces us to do a bit more previewing with a little less reflection.

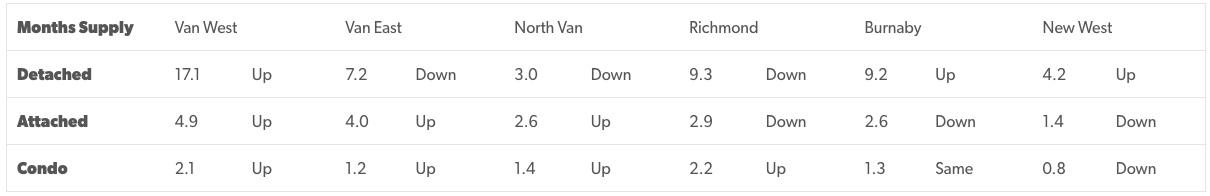

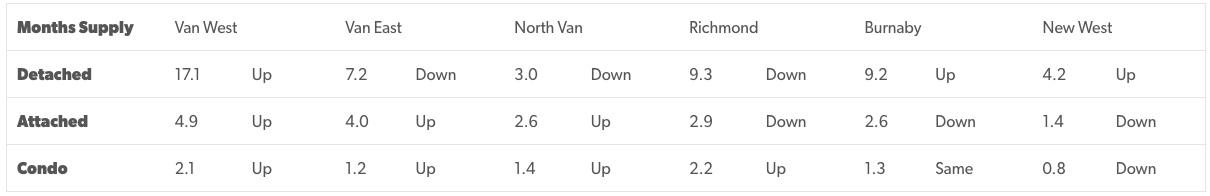

Nevertheless, let’s start with the usual stats – the numbers shown are a ratio of the number of active listings (at end of month) over the number of sales in that month. Numbers above a 7 are considered to be buyers’ markets, below a 5 are sellers’ and in-between are considered balanced. Beside the number, I’ve indicated the direction the market moved when compared to the previous month.

These numbers are clearly all over the map – detached homes on the West side of Vancouver appear to be in one of the strongest buyer’s markets we’ve seen in a long time while condos in New West (and indeed, across the region) appear to be in a strong seller market. As an overall generalization, the end of December saw us continue to have two very different markets – with detached homes continuing to be fairly slow with ample choice and attached homes and condos continuing to be extremely active.

I think the most interesting thing to glean from the numbers is that the lower the price point, the hotter the market – regardless of product type. Indeed, (taking North Vancouver detached homes out of the analysis), you can almost see a line from $10M + down to $300K and the lower you get, the more the market favours sellers. It further appears that in market segments where the average pricing hovers around $800K – $1.2M, we’re seeing our most balanced markets.

Now that we’re a bit in to January, it’s both fun and useful to speculate what this year will bring to our market. Currently, the market dynamics haven’t shifted as dramatically as they usually do at the beginning of a new year. Entry level condos are still extremely busy (our open house of a one bedroom west side condo in Vancouver saw 57 groups come through the door in two days). More interesting, however, is that the new year seems to have brought a renewed level of interest in detached homes – open houses of $3.0M homes were also extremely busy over the weekend. There was rampant speculation leading into January that the new OSFI stress-test requirements (uninsured mortgages must now qualify at a higher rate than the contract rate) would have a dragging effect on the market; early indications in our market, however, would seem to indicate that the new stress test has had little to no actual effect (other than the psychological impact it had in pushing some buyers to buy in the fall rather than this spring).

All indications are that the Bank of Canada will raise it’s overnight rate again this week – most of the major lenders have already increased their rates in anticipation of that announcement. I believe that the Bank of Canada is targeting another 0.75% rate increase over the course of this year (with a 0.25% happening this week). As interest rates climb, it is our expectation that this will have an actual dragging effect on the market and as such, I expect that by the end of the year, we’ll likely be in a more balanced market across the region in most of our market segments. I would add that there is widespread speculation that the provincial budget that will be delivered on February 20th will bring with it some measure designed to cool the real estate market. It would therefore come as little surprise to me if we saw our usual spring market interrupted for a few weeks as we adjust to whatever new policy announcement comes out of the budget.